Fact Sheet

SOCIAL SECURITY

2023 SOCIAL SECURITY CHANGES

Cost-of-Living Adjustment (COLA):

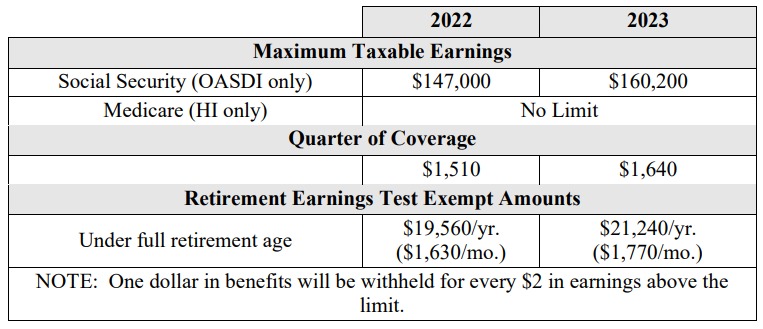

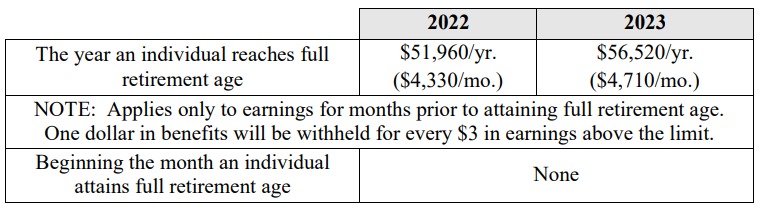

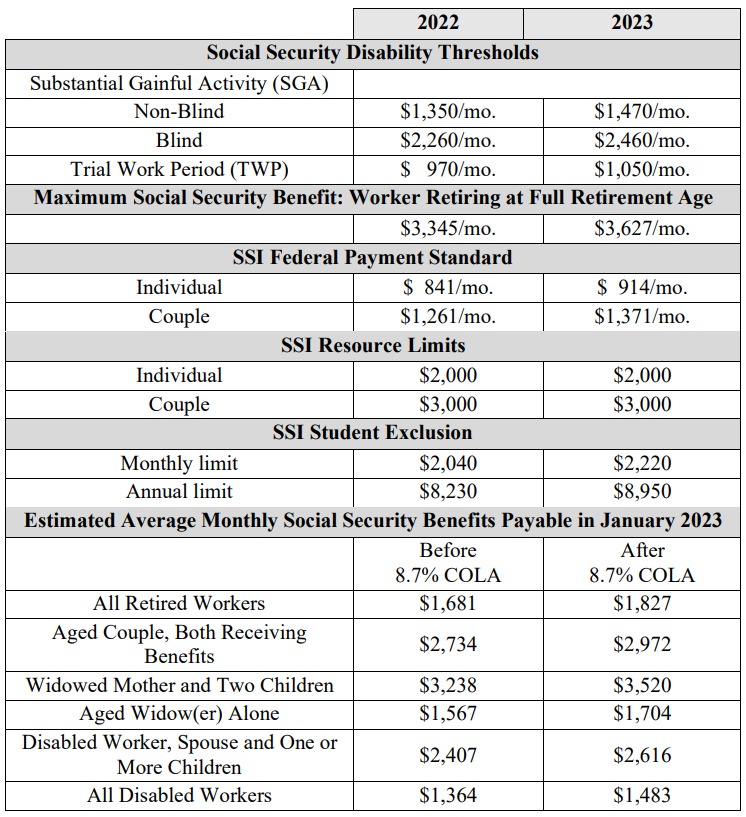

Based on the increase in the Consumer Price Index (CPI-W) from the third quarter of 2021 through the third quarter of 2022, Social Security and Supplemental Security Income (SSI) beneficiaries will receive an 8.7 percent COLA for 2023. Other important 2023 Social Security information is as follows:

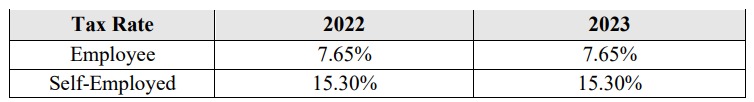

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings. Also, as of January 2013, individuals with earned income of more than $200,000 ($250,000 for married couples filing jointly) pay an additional 0.9 percent in Medicare taxes. The tax rates shown above do not include the 0.9 percent.

Social Security National Press Office Baltimore, MD

This press release was produced and disseminated at U.S. taxpayer expense.